Home Improvement News Can Be Fun For Everyone

Wiki Article

The Best Guide To Home Improvement News

Table of ContentsThe Main Principles Of Home Improvement News Unknown Facts About Home Improvement NewsExcitement About Home Improvement NewsIndicators on Home Improvement News You Should Know

So, by making your home more secure, you can in fact make an earnings. The interior of your residence can obtain obsoleted if you do not make modifications and upgrade it every now and then. Interior decoration styles are always changing as well as what was trendy 5 years ago might look ludicrous now.You might also feel burnt out after checking out the exact same setup for several years, so some low-budget modifications are always welcome to provide you a bit of adjustment. You choose to incorporate some timeless aspects that will certainly continue to appear current as well as trendy throughout time. Do not worry that these improvements will be pricey.

Pro, Suggestion Takeaway: If you really feel that your house is as well tiny, you can remodel your cellar to increase the quantity of space. You can utilize this as a spare space for your household or you can rent it out to produce additional earnings. You can make the most of it by employing experts that give remodeling solutions.

The 5-Minute Rule for Home Improvement News

Home remodellings can enhance the method your residence looks, yet the advantages are moreover. When you collaborate with a trusted renovation company, they can help you improve efficiency, function, lifestyle, and also worth. https://www.imdb.com/user/ur168844704/. Hilma Building in Edmonton deals total restoration solutions. Continue reading to find out the benefits of home improvements.

Regular house upkeep as well as repairs are needed to maintain your building value. A house renovation can assist you keep as well as raise that value. Utilizing a residence equity car loan to make residence improvements comes with a few advantages that other uses do not.

How Home Improvement News can Save You Time, Stress, and Money.

That set rate of interest rate suggests your month-to-month repayment will certainly be consistent over the term of your loan. In an increasing passion price environment, it may be less complicated to factor a fixed settlement right into your budget. The other choice when it comes to tapping your home's equity is a house equity line of credit score, or HELOC.You'll only pay interest on the cash you've borrowed throughout the draw duration, however, generally at a variable rate. That implies your regular monthly repayment undergoes change as rates increase. Both house equity loans as well as HELOCs utilize your house as collateral to safeguard the finance. If you can not manage your regular monthly repayments, you can shed your home-- this is the greatest danger when borrowing with either kind of loan.

Consider not simply what you want right now, however what will interest future buyers since the jobs you choose will affect the resale value of your home. Job with an accounting professional to see to it your interest is properly subtracted from your taxes, as it can save you 10s of countless dollars over the life of the lending (commercial property management).

9 Easy Facts About Home Improvement News Explained

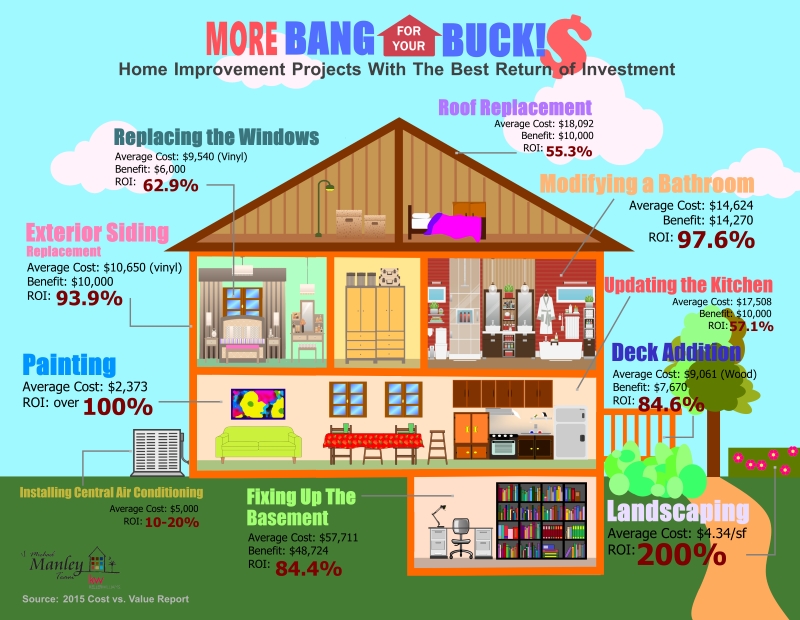

Home equity loans have low rates of interest contrasted with other sorts of fundings such as personal fundings as well as credit score cards. Present residence equity rates are as high as 8. 00%, however individual lendings go to 10. 81%, according to CNET's sis site Bankrate. With a house equity lending, your rate of interest will be taken care of, so you do not need to worry regarding it rising in a rising rate of interest setting, such as the one we remain in today.As pointed out over, it matters what kind of renovation projects you carry out, as specific residence renovations provide a greater return on financial investment than others. As an example, a small cooking area remodel will certainly recoup 86% of its value when you offer a home contrasted with 52% for a timber deck enhancement, according to 2023 information from Redesigning publication that examines the expense of renovating projects.

While residential property worths have actually escalated over the last two years, if house prices go down for any kind of factor in your area, your investment in improvements will not have really boosted your house's value. When you end up owing much more on your mortgage than what your residence is in fact worth, it's called unfavorable equity or being "underwater" on your mortgage.

A HELOC is typically better when you desire a lot more flexibility with your car loan. With a Click This Link fixed-interest rate you do not need to stress over your repayments going up or paying extra in rate of interest in time. Your monthly repayment will constantly coincide, whatever's taking place in the economic situation. Every one of the money from the finance is dispersed to you upfront in one repayment, so you have access to all of your funds immediately.

Report this wiki page